Conversation | Our team

Thoughts from my first weeks

I think for us interns, we are all on our way towards something, it may be continued studies, possibly another internship or the first full time job. Altor is for us and me an important step on that journey – it helps us to figure out the direction we want to take.

Conversation | Our team

Embracing Curiosity – introducing Julius Höh

It is really about listening. If you want to succeed, you have to nurture your curiosity and look at how you can challenge what is a proven formula – that you do best by ‘being out there’, seeking new people and territory.

News | Press release

15 Feb 2024

Altor has increased its financial interest in Mandatum by an additional 6.6% of the outstanding shares

News | Press release

13 Dec 2023

Eleda Gets New Ownership:

Altor Sells Controlling Stake to Bain Capital, Companies Form Partnerships for Future Expansion

Conversation | Case

Turning ordinary tap water into tasteful experiences

Starting out as an engineering and design company aiming to make everyday objects better and more beautiful, Aarke is now embarking on a journey towards a greener future with a new subscription service at its core.

News | Press release

12 Feb 2024

Altor completes the public cash offer to the shareholders of Permascand and acquires over 90% of the shares

Conversation

It’s time to wrap up the year of 2023

We put together Altor’s wrapped to show what sparked the interest among you the most. Have a look. A hint, we seem to have a lot in common.

Conversation | Perspective

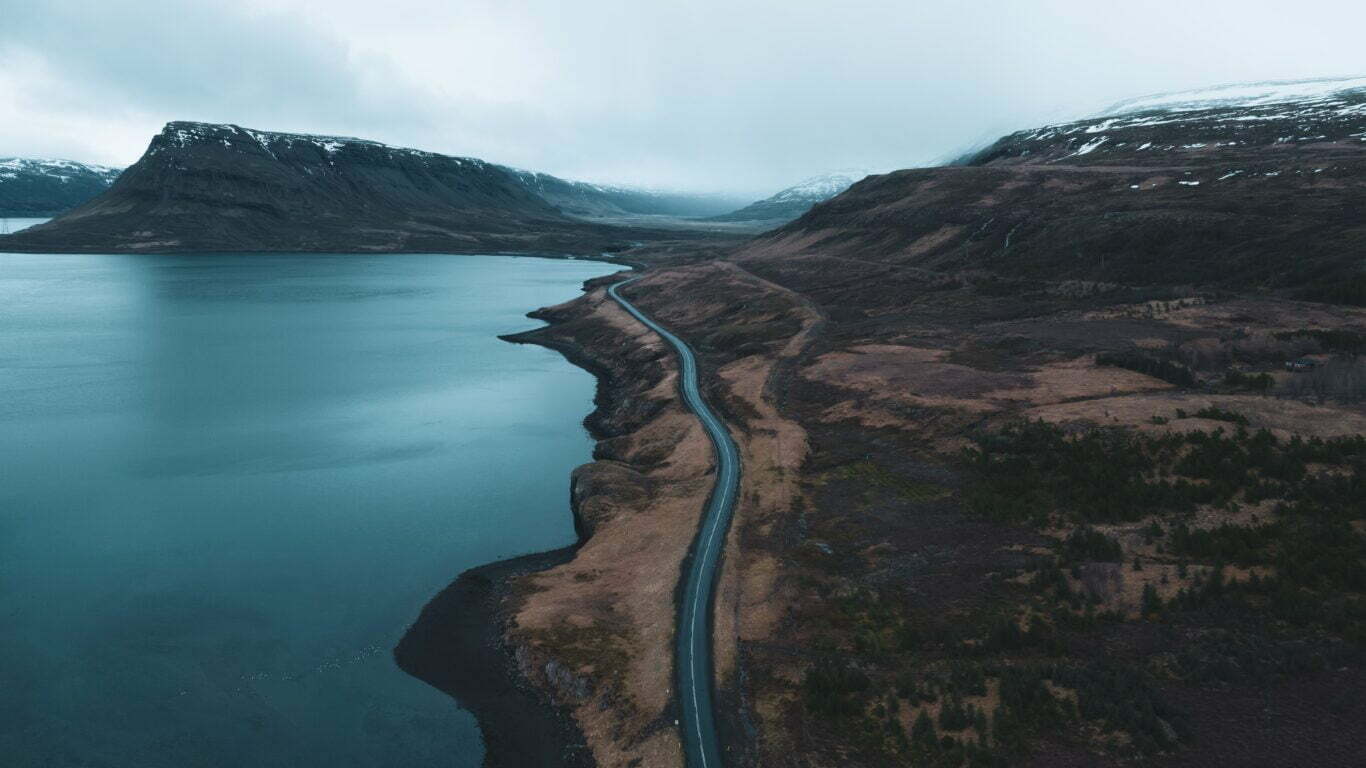

Ten years later, still going strong

Helly Hansen was Altor’s first investment in the Consumer sector. A company part of the Norwegian heritage. During our nine years of partnership, the brand reconnected with its roots, the product portfolio improving every season and the operation developed a world class apparel company.

Conversation | Spotlight

Trust me, you’ll want to move in.

Every year we are looking for curious students to join our team as Investment Interns. Hoping that in a few years’ time, we’ll work side by side again.

Some of the companies we partner with

2023 turnover (Calendar year)

EUR 25M

Employees

41

Investment date

Nov 2020

Fund

Fund V

2023 turnover (Calendar year)

EUR 21M

Employees

~600

Investment date

Aug 2023

Fund

Fund VI

2023 turnover (Calendar year)

EUR 135M

Employees

ca 624

Investment date

Dec 2019

Fund

Fund V

2023 turnover (Calendar year)

Employees

Investment date

Dec 2021

Fund

Fund V

2023 turnover (Calendar year)

EUR 63M

Employees

108

Investment date

May 2009

Fund

Fund III

2023 turnover (Calendar year)

EUR 292M

Employees

ca 787

Investment date

May 2009

Fund

Fund III

2023 turnover (Calendar year)

EUR 25M

Employees

< 100

Investment date

Dec 2017

Fund

Fund III

2023 turnover (Calendar year)

EUR 1408M

Employees

2590

Investment date

Jun 2020

Fund

Fund V

2023 turnover (Calendar year)

EUR 110M

Employees

566

Investment date

Apr 2018

Fund

Fund IV

2023 turnover (Calendar year)

EUR 112M

Employees

ca 287

Investment date

Mar 2016

Fund

Fund IV

2023 turnover (Calendar year)

EUR 3234M

Employees

11 000

Investment date

Jan 2023

Fund

Fund V

News | Press release

15 Sep 2023

Altor to invest in Marshall Group

Conversation | Spotlight

What the world needs now

“This is the decade of action,” says Stephanie Hubold, Head of Sustainability. Watch the interview and learn more about Altor’s commitment.

Conversation | In the media

Learning from the best

What motivates our decisions and how much of our career path can we control? When listening to Mattias Miksche tell stories from his life, we are reminded that the path to becoming an entrepreneur can take many forms. In Swedish.

During our 20 years, the stories of great challengers and change makers are endless.

Building the tomorrow is the work of many people, not one person alone.