Sustainability

There is a great potential in strengthening our portfolio’s performance on Environmental, Social, and Governance matters, and promoting the green transition.

Based on Altor’s strong commitment to ESG (Environmental, Social, Governance), our fiduciary duty, and a belief that ESG has a positive impact on investment returns, ESG integration is a natural part of our investment strategy. We are in it for the long haul, and it isthis mindset that entrepreneurs who have successfully partnered with us over the years appreciate.

Whilst sustainability has been a natural and significant part of our mission to create superior and lasting value in our portfolio companies, recent years have made this conviction even stronger. With our heritage in Scandinavia, we are at the very center of some of the world’s most exciting initiatives and businesses working to solve today’s challenges, with a healthy planet and people in mind.

With our tradition of building great businesses in deep partnerships, we have already made a handful of exciting investments with management and other green pioneer investors in companies that can accelerate the green transition and redefine the industry landscape.

Downloads

Responsible Investment and Ownership Policy

Sustainability reports

UN PRI Transparency Reports

Norway Transparency Report

Stephanie Hubold | Head of Sustainability“Solving today’s environmental and societal challenges is not an easy feat. We don’t need more (stand-alone) sustainability strategies, but true sustainable business strategies that challenge conventional approaches.”

Altor plans to be a part of Europe’s green transition, driving an industrial revolution and helping the whole continent decarbonize. Watch the film to learn more about Altor’s view on the Green Transition

How to drive value creation

Throughout Altor’s ownership our investment and value creation teams support the companies and their management teams to reach their full potential. Altor’s investments are currently focused around five sectors:

- Consumer

- Industrial

- Business Services

- Financial Services

- Tech

Whilst spread across sectors and geographies, Altor is truly a one-firm company with a highly collaborative partnership focused on transparency, joint prioritization and teaming up to drive investments and value creation.

Altor makes a significant investment in driving strategic and operational transformation in its portfolio companies. A broad network of seasoned senior experts with significant operating experience can support as board members or advisors to help drive lasting impact in the companies.

By establishing our value creation team, we have been able to accelerate portfolio company transformations, significantly strengthen our portfolio company leadership bench, and improve performance management and reporting, all while making a step change in integrating ESG into all aspects of our investment activities.

Consumer 19%

Industrial 27%

Business Services 27%

Tech 9%

Financial Services 18%

Our targets and standards

At Altor, we firmly believe that high ESG standards are an integral part of future-proofing businesses. Sustainability is a key lever to generate long-term value. This is why we have joined a number of strategic partnerships to formalize and underline these ambitions (see Memberships below). The increased transparency and guidance they offer are important in attaining our high ESG standards, amongst others to align our business to reach the 1.5°C target set in the Paris Agreement.

Four prioritized topics linked to the UN’s Sustainable Development Goals

We have prioritized four ESG topics linked to UN Sustainable Development Goals (SDGs) to guide our ESG work. For each topic there are relating ESG Standards in our RIO policy. Our commitments go beyond compliance with rules and regulations as it is our firm belief that strong ESG practices not only benefit the environment and society, but also drive value creation for the Altor funds.

We place an emphasis on the following four prioritized ESG topics, which are linked to the SDGs:

Diversity & Inclusion

Representation, Diversity and Inclusion

Altor actively promotes diversity by working towards fair representation through training, addressing unconscious bias, and creating an inclusive culture. This is particularly important in employee recruitment and staffing of leadership positions, with an emphasis on gender diversity.

Altor is committed to equal pay for equal work, and gender diversity in the recruiting funnel. Internally, this is led by a 50% intake target, and the commitment to challenge headhunters to present shortlists with diverse candidates.

With contract renewals, we also request that our professional service advisors and financial advisors have diverse service teams, with a target of at least 30% of the underrepresented gender.

Working conditions & living wage

Ensuring living wages

Unfortunately, while it should be taken for granted in the 21st century, not all companies provide a proper living wage in their operations or supply chains. Hence, it is a focus of Altor’s active ownership approach to improve the standards of portfolio companies and their suppliers. At a minimum, our goal is to meet the national legal minimum wage, industry benchmark standard or living wage definition – whichever is highest. In all circumstances, wages shall be enough to meet basic needs and provide some discretionary income.

Zero tolerance for discrimination

Altor does not tolerate discrimination or harassment of any type. This includes discrimination or harassment based on, but not limited to, age, race, gender, religion, sexual orientation, or disability.

Health and safety in operations and supply chains

We expect a relentless commitment to zero fatalities, zero high-consequence work-related injuries or ill health in a companies’ own operations and material part of the supply chain.

Right to freedom of association

We are committed to the employees’, contractors’, and suppliers’ right to freedom of association. This means their right to collective bargaining should be ensured through internal and supplier code of conducts. We accept no incidents of breaches such as hindering entry, registration, or organizational operation.

Environmental performance and Circular resource management

Best-in-class environmental and circular performance

For all environmental aspects determined as material for the respective company and/or industry (such as circular resource management, water, land use, biodiversity), expectation is to manage them towards being best-in-class among peers – with targets and a milestone plan.

Climate action

Science-based targets in line with the Paris Agreement

We have committed to the Science Based Target Initiative (SBTi) 1.5°C business ambition in November 2021, and are now working to set our concrete climate target and get it approved. At the portfolio company level, a SBTi-aligned climate target typically means halving emissions by 2030, where possible covering a company’s entire value chain emissions, i.e., including those produced by their own processes (scope 1), purchased electricity and heat (scope 2), and generated by suppliers and end-users (scope 3).

In addition, companies should set a net-zero target for 2050, while striving for 2045. Net zero means producing close to zero emissions and using carbon removals to neutralize any residual emissions that are not possible to eliminate. Most companies will require deep decarbonization of 90-95% to reach net-zero under the Standard. This commitment is designed to last after Altor’s time of ownership.

Lastly, Altor encourages companies to invest in beyond value chain mitigation outside their science-based targets (near-term climate finance), to help mitigate climate change elsewhere. Companies should follow the mitigation hierarchy, and invest only in high-quality offsets schemes.

Transition and physical impact from climate change

Compared to other areas of ESG which usually focuses on the impact a company has on ‘the world’, transition and physical impact from climate change rather refers to the impact climate change will have on a company. If this is a material topic, Altor expects it to be assessed as per guidance by the Task Force on Climate-Related Financial Disclosures (TCFD).

In line with TCFD guidance Altor worked with an external consultant to conduct a climate scenario analysis scan during the beginning of 2022 with the objective of identifying key risk hotspots in our portfolio. For this initial assessment, we focused on transition risks, that is, impacts resulting from society’s response to climate change in terms of policy and legal changes (for example carbon regulations), technology developments; consumer and market shifts; and reputational risk.

The analysis found that Altor’s portfolio is only moderately exposed to transition risks, though select holdings in the Industrial and Consumer sectors may face higher transition risk exposure should society move quickly to decarbonize. For these, and other holdings with potentially higher exposure, we conducted deep dives and initiated discussions with the portfolio companies on adequate mitigation plans.

Responsible investments and ownership policy

Early in 2012, Altor launched its first Responsible Investment & Ownership Policy (RIO) defining commitments and ambitions around ESG. The purpose of the policy is to clarify our ESG strategy, outline how ESG is managed throughout Altor’s investment and ownership process, and establish the ESG standards throughout the portfolio. The policy applies to all Altor funds, portfolio companies and business partners.

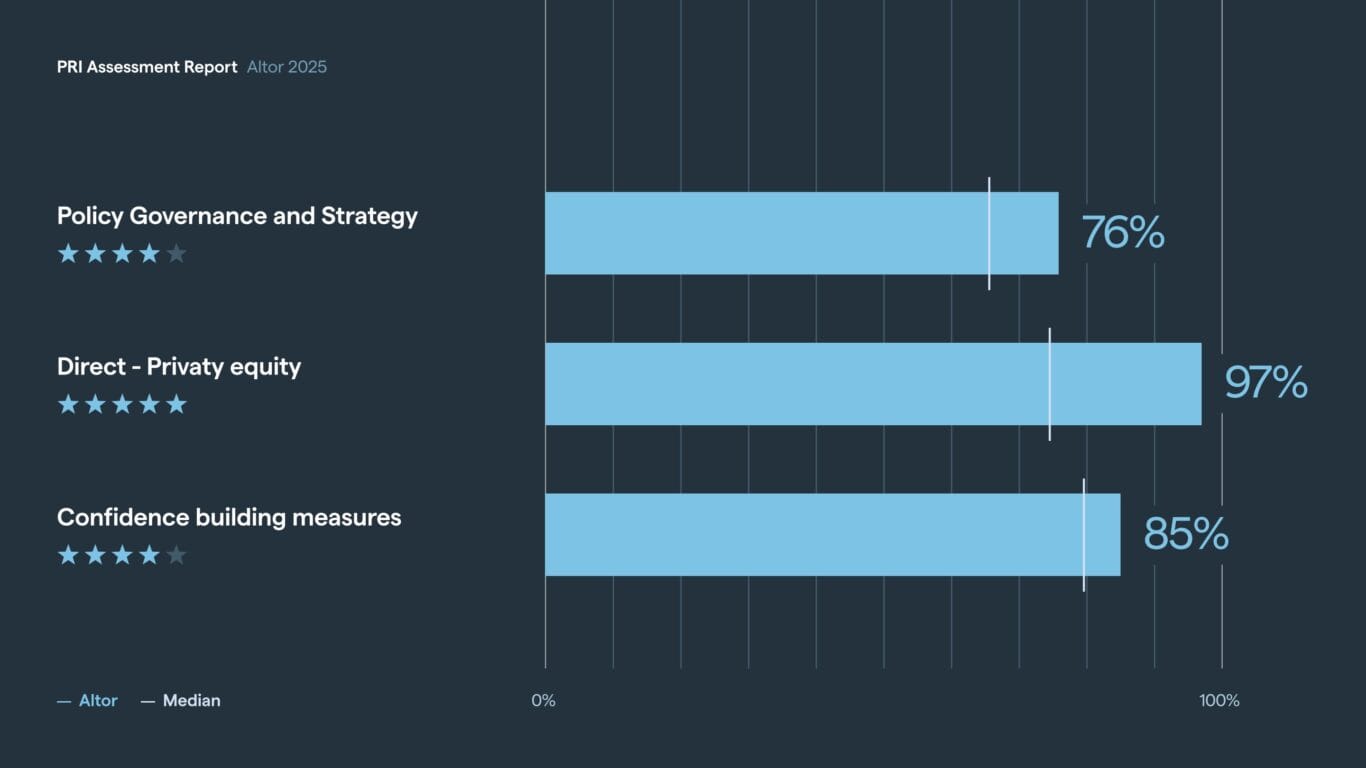

The UN’s principles for responsible investments

An important step was taken in 2014 when the Altor Funds became signatories of the UN Principles for Responsible Investment (PRI). By committing to the six principles of PRI we are improving and continuing our efforts to create a more sustainable financial system. As signatories, we undergo an assessment each year and present the results in Altor’s PRI transparency report.

Read the Transparency report 2025

Science-based targets initiative

In 2021, the Sciences Based Target initiative (SBTi) presented guidance for the private equity sector. The guidance was formed to help private equity funds set and reach targets for their operations and investments in line with the 1.5°C degree target set in the Paris Agreement. Stephanie Hubold, Head of Sustainability at Altor, played an active role in developing the guidance as a member of SBTi’s Private Equity Expert Advisory Group. In connection with the launch of the private equity guidance document, Altor committed to the 1.5-degree ambition and having a science-based target approved before the end of 2023. The targets will apply to all Altor funds and portfolio companies.

Our ESG approach

The investment phase

ESG is critical during the screening and sourcing of activities. Early exclusions are made based on the formalized exclusionary list in Altor’s RIO policy. Screening is also opportunity-driven with a focus on investments in solutions to global challenges and especially the green transition. It is also a mandatory part of Due Diligence to ensure full understanding and comfort in a potential target’s ESG status, key risks and opportunities.

Both our Investment Advisory Committee and the Fund Board of Directors always considers ESG in an investment decision and it is an important aspect of the risk assessment, mandated by AIFMD. Risk and/or issues either lead to a recommendation not to proceed, or formalized ESG actions that are part of the three-year value creation plan.

The ownership phase

ESG is part of the business value creation planning process, and at times a key value creation lever of a company. The goal is to complete the value creation plan with an integrated ESG-strategy within six months of the investment. ESG is also a mandatory discussion topic at least twice a year at each company’s Board of Directors’ meeting.

Altor has a comprehensive and quantitative ESG performance monitoring process to annually track progress against our ambitious ESG standards in the RIO policy. Naturally, ESG often plays a big role in strategy retakes of our portfolio companies.

To strengthen awareness and capabilities in the portfolio companies, and allow for best practice exchange, we have set up ESG network meetings with all of the portfolio companies’ ESG leads that are conducted on an ongoing basis. These meetings set a foundation in our work with the portfolio companies to foster understanding of ESG as a framework for innovation.

In making the exit readiness assessment, we ensure solid processes and governance regarding ESG. Transparency on ESG performance, a clear ESG strategy with high ESG standards, is also an important part of the exit process where we leverage the work that has been done throughout our ownership.

01

Environment, Social, Governance assessment

- Screening: Agree on Go/No go

- Due diligence: Tailored approach for each situation to ensure full understanding and comfort in the company’s ESG status and feasibility to manage up to Altor’s ESG standards

02

Three-year master plan creation

- Initial phase: Onboarding processes and assessments to integrate ESG to the 3-year value creation master plan, to facilitate growth and cost reduction initiatives

- Make ESG an integral part of the business agenda

- The Board defines the ESG framework based on Altor’s approach and RIO policy

03

Delivering on ESG-plan

- Governance and operational processes to ensure high performance on ESG in the line with Altors ESG approach and RIO policy

- Quarterly process to review and follow up on companies ESG performance and compliance

- Board routines: Mandatory to discuss ESG performance and risk matters minimum twice a year in each company’s Board

04

Exit preparations

- Ensure that solid processes and documentation are in place

- Ensure that the high ESG performance is accounted for an valued correctly by a potential buyer

Memberships

Altor is a member of several partnerships and associations, as we believe that a collaborative approach is key to accelerating sustainable transformations.

Through these partnership organizations, Altor seeks to advance the ESG agenda in the private equity industry. With that purpose, Altor also actively participates in the (informal) Nordic Responsible Investment forum.